Books

New!

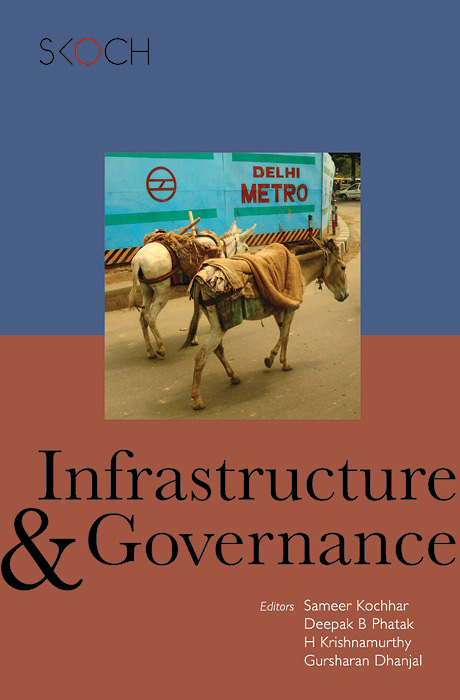

Buy on Amazon

New!

Buy on Amazon

Buy on Amazon

Buy on Amazon

Books

At the Intersection of Law & Life: Essays in Honour of Justice MN Venkatachaliah

Bibek Debroy and Sameer Kochhar

INCLUSION

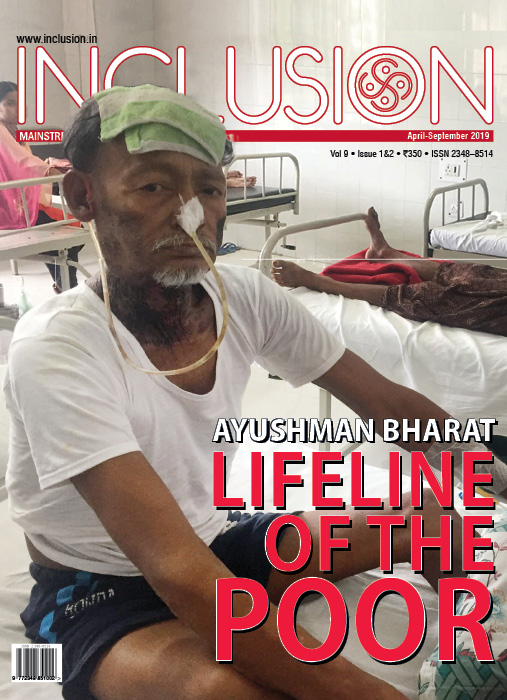

New!

New!

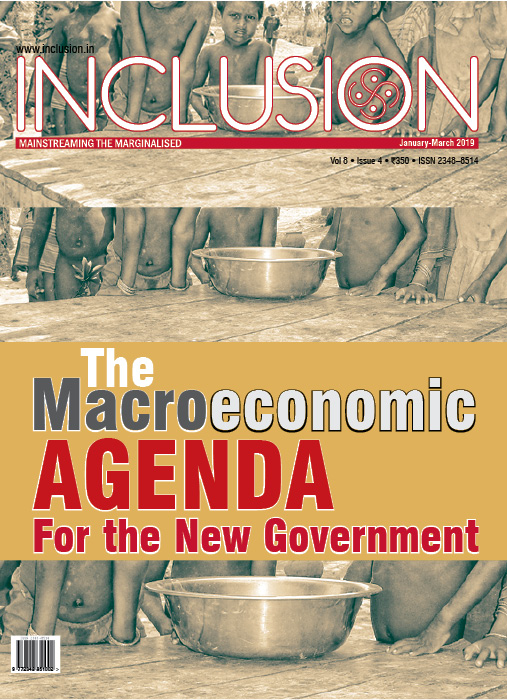

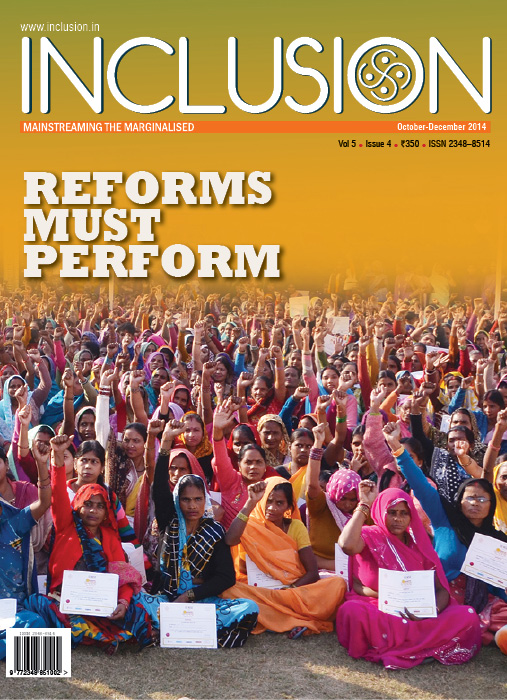

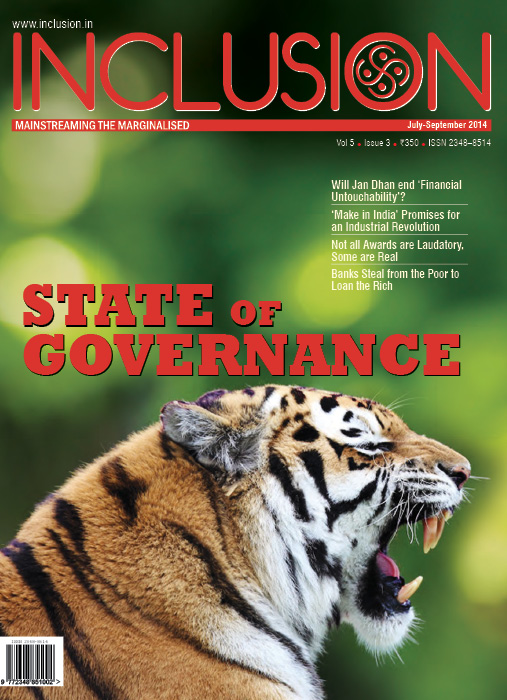

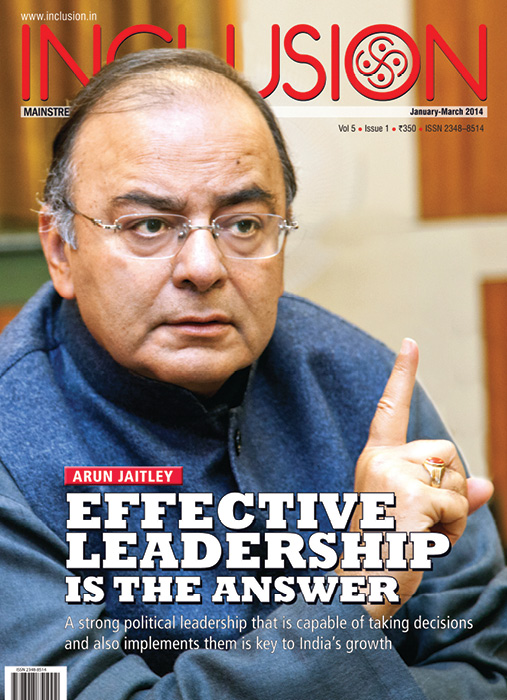

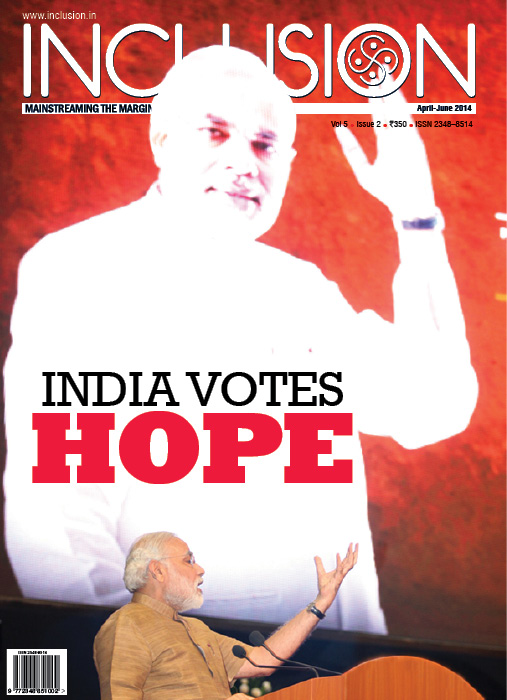

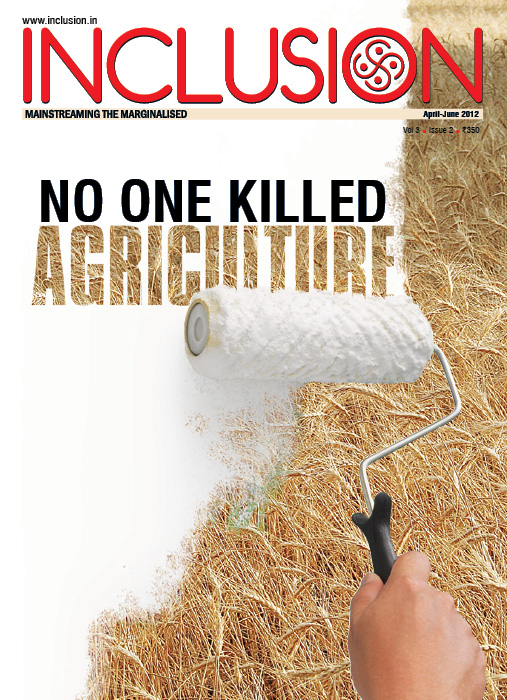

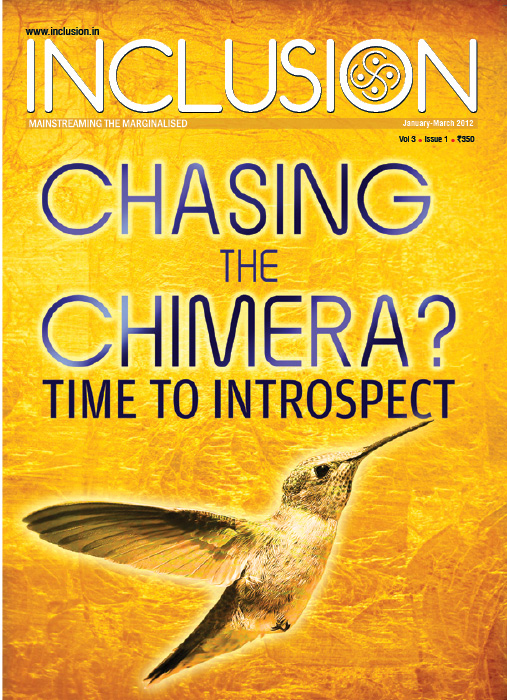

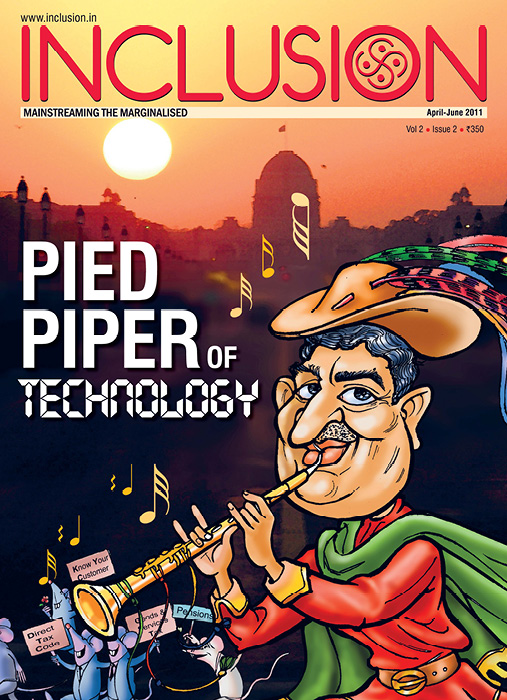

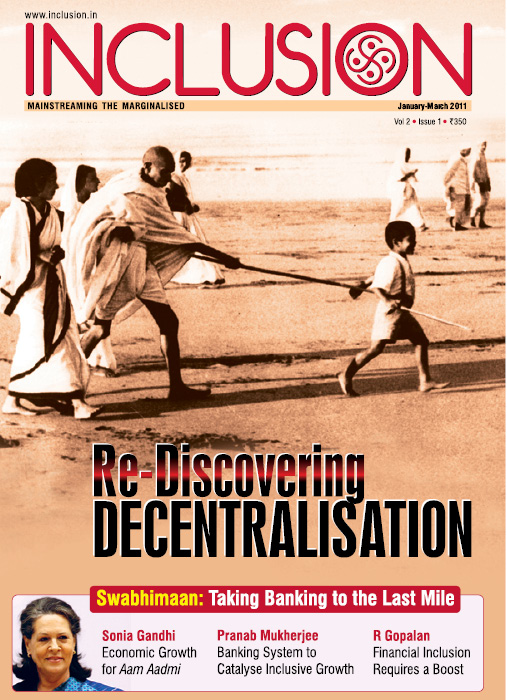

INCLUSION

SKOCH State of Governance Report 2023

INCLUSION

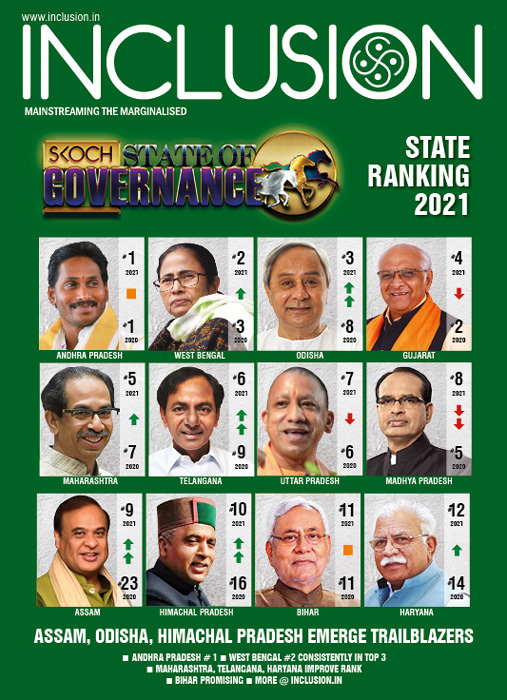

SKOCH State of Governance Report 2021

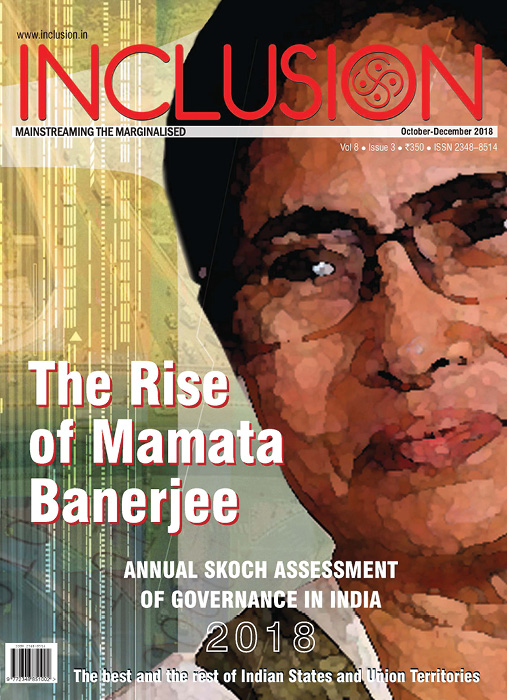

INCLUSION

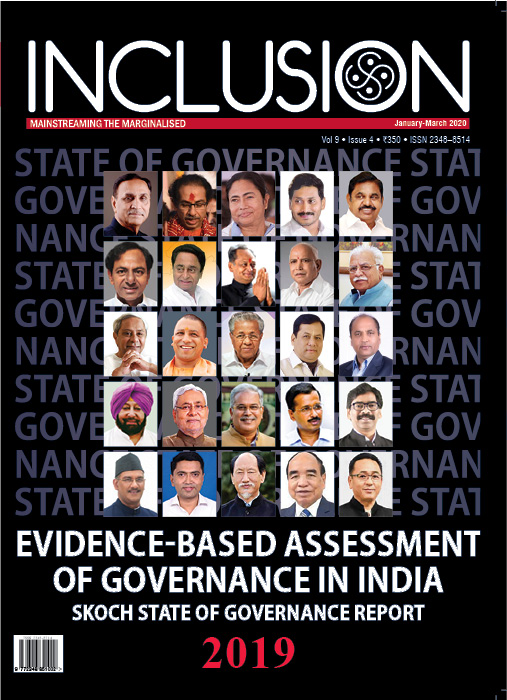

SKOCH State of Governance Report 2020

INCLUSION