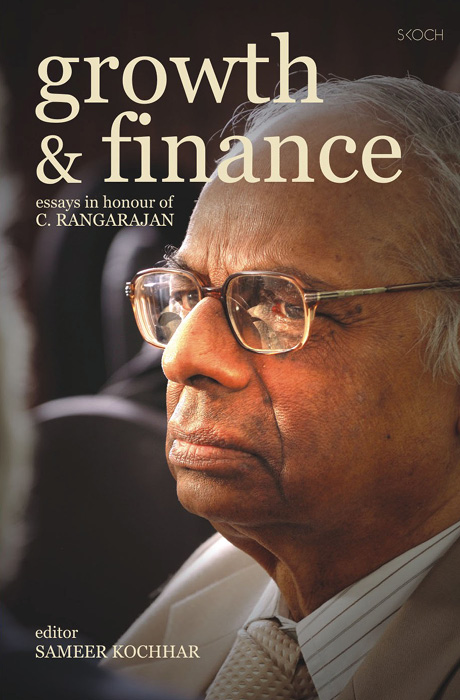

Growth & Finance: Essays in Honour of C. Rangarajan

Author: Sameer Kochhar

Pages: 336

ISSN: 978-81-7188-866-5

Language: English

Edition: First

Pub. Year: 2011

In this timely book—a festschrift for Dr. C. Rangarajan—top experts, policymakers and economists offer their assessments of India’s performance in the area of economic and financial reforms and analyse the successes and continued challenges. It provides an insight into critical macroeconomic and macro-finance issues of today. The book covers a broad set of topics, including fiscal, monetary and external sector policies, drivers of banking and financial growth, infrastructure and financial inclusion.

A strategy of gradual economic liberalisation combined with risk-averse prudential regulation in the banking and financial sector helped limit India’s exposure to the recent financial crises and the subsequent global economic slowdown. The improved economic performance in recent years encouraged the country to become more globally and regionally integrated. This process is unlikely to be reversed by the current global economic slowdown, given the economic and strategic benefits India has derived so far.

The authors in this festschrift share a critical, but overall positive, view of the country’s future and outline several areas and recommendations for bettering the lives of citizens. Empirically rich and topically diverse, the book is broad in scope and full of deep analytic insights and will serve as a useful reference and planning tool for administrators, planners, policymakers and students of development economics, monetary economics and finance.

- Episodes from Monetary and other Financial Policies (1982-1997): An Anecdotal Presentation — S.S. Tarapore

- Transparency and Autonomy Issues in Monetary Policy — K. Kanagasabapathy and Balamurali Radhakrishnan

- Inflation, Macroeconomic Policy and Hunger: A Variation on a Theme by C. Rangarajan — Raghbendra Jha

- From Growth to Inclusive Growth: The Current Challenges — Joseph Massey

- Should Banking be made Boring?: An Indian Perspective — Duvvuri Subbarao

- Efficiency, Productivity and Soundness of the Indian Banks: Recent Developments — Y.V. Reddy and Swayam Prava Mishra

- Macroprudential Approach to Regulation: Scope and Issues — Shyamala Gopinath

- The Use of Composite Infrastructure Indices to Catalyse Infrastructure Development — Ravi Parthasarathy

- Role of Financial Markets in Driving Financial Inclusion — Madhu Kannan

- Credit Markets and Financial Inclusion — Kartikeya Desai and Nitin Desai

- Reinventing NABARD — K.G. Karmakar

- Technology and the Financial Inclusion Imperative in India: Banking and Dr. Rangarajan— The Philosopher King — K.C. Chakrabarty

- Managing Sovereign Risk: An Integrated Approach for Sovereign Assets and Liabilities — Udaibir S. Das

- Securities Market Development: Indian Experience and Some Lessons for Future — Ravi Narain

- Evolution of India’s Exchange Rate Regime — Ashima Goyal

- Indian Economy in the Global Meltdown — Kirit S. Parikh

K.C. Chakrabarty, a seasoned banker with an accomplished banking career spanning over three decades donned the role of a central banker on June 15, 2009 after he assumed charge of the office of Deputy Governor in Reserve Bank of India (RBI). His current assignments at RBI include guiding and overseeing the areas pertaining to rural and urban cooperative banks, information technology, payment and settlement systems, customer services, human resource and personnel management. Before taking over as the Deputy Governor, Dr. Chakrabarty graced the seat of Chairman & Managing Director (CMD), Punjab National Bank for over two years and before that, the CMD, Indian Bank for two years. He was also the Chairman of the Indian Banks’ Association (IBA) for a brief period. He has recently published a widely acclaimed book with Sameer Kochhar, R. Chandrashekhar and Deepak B. Phatak entitled Financial Inclusion (2009).

Udaibir S. Das is an Assistant Director in the Monetary and Capital Markets Department of the IMF. He heads the Sovereign Asset and Liability Management Division and leads a team that covers policy and operational issues relating to sovereign risk, debt, reserves and other sovereign assets, debt capital markets, and related financial stability issues. He is also closely associated with country-specific vulnerability assessments, financial stability surveillance, and actively associated with several international and regional initiatives in financial sector, debt, and capital market areas. Das is a Fulbright-Humphrey scholar with graduate degrees in Economics and Management (US). He was a lecturer in finance at Boston University (US) during 1989-1991. He joined the IMF in 1996. Prior to joining the IMF, he was with the Reserve Bank of India for 18 years. He has published in several professional journals and holds a research interest in central banking, financial stability, debt restructuring, and different aspects of debt and fixed-income markets.

Kartikeya Desai is Vice President at Lok Capital, an innovative platform delivering equity capital combined with technical and strategic support for Indian microfinance institutions and social enterprises serving the bottom of pyramid segment. He is a frequent commentator on policy issues relating to development finance and has contributed substantially to the public dialogue on microfinance and social enterprise. Prior to joining Lok Capital in early 2009, he worked for DSP Merrill Lynch, first in the investment banking group and then in the private equity team. Earlier he worked in the BTS Group in the USA as a management consultant after graduating from the School of International and Public Affairs, Columbia University and the Wharton School at the University of Pennsylvania.

Nitin Desai, a graduate of London School of Economics (LSE), taught economics at two UK Universities, worked briefly in the private sector, had a long stint as a government official in India and then joined the UN in 1990. In India, he joined the Planning Commission in 1973, and worked there till 1988. Later he joined the Ministry of Finance as the Chief Economic Adviser (1988-1990). In the UN, he was Under-Secretary General for Economic and Social Affairs. After his retirement he has been involved in a variety of public policy activities nationally and internationally. He is a member of the National Security Advisory Board (NSAB) and the Prime Minister’s Council on Climate Change. He is a Distinguished Fellow of TERI and is an Honorary Fellow of the LSE. He writes a monthly column in the Business Standard.

Shyamala Gopinath is Deputy Governor, Reserve Bank of India (RBI). She is also a member representing the RBI on the Financial Stability Board. She is a career central banker, having joined the RBI in 1972 and except for a brief stint with International Monetary Fund (IMF) during 2001-2003, she has since been with the RBI. At IMF she was associated with areas relating to foreign exchange reserves management, safeguard assessment and foreign exchange markets and was part of IMF missions for financial sector assessment programmes to many countries. She has vast experience across the financial policy spectrum spanning banking and non-banking regulation, financial market regulation, public debt management, foreign exchange reserves management, foreign exchange management and payment & settlement systems.

Ashima Goyal is a professor at the Indira Gandhi Institute of Development Research (IGIDR), Mumbai, India. She has been a faculty member in the Delhi School of Economics (DSE) and Gokhale Institute of Politics and Economics (GIPE), India, a visiting fellow at the Economic Growth Centre, Yale University, USA, and a Fulbright Senior Research Fellow at Claremont Graduate University, USA. Her research interests are in institutional macroeconomics, the open economy, international finance, development and governance. She is the author of numerous international and national publications, a book on Developing Economy Macroeconomics: Fresh Perspectives (1999), and has participated in research projects with World Bank, Global Development Network (GDN), Reserve Bank of India (RBI), Asian Development Bank (ADB), and United Nations Economic and Social Commission for Asia and the Pacific (ESCAP). Her research has received national and international awards. She is co-editor of a new Routledge journal on macroeconomics and finance. She is also active in the Indian policy debate, and is a member of several government committees, boards of educational and financial institutions. She contributes a monthly column to the Hindu Business Line.

Raghbendra Jha, PhD (Columbia), Elected Fellow of the World Innovation Foundation (FWIF), is professor of Economics and Executive Director Australia South Asia Research Centre, Australian National University. He has previously taught at Columbia University and Williams College in the US, Queen’s University (Canada), University of Warwick (UK) and Delhi School of Economics, IIM (Bangalore), and Indira Gandhi Institute of Development Research in India (IGIDR). He has authored/edited 23 books. He has more than one hundred papers in leading refereed international scientific journals such as Journal of Development Economics, Journal of Economic Behavior and Organization, Energy Economics, Southern Economic Journal, Applied Economics, Public Finance, Public Finance Review, Public Choice, Journal of Comparative Economics, Empirical Economics, Journal of Asian Economics, World Development, World Economy, and International Review of Applied Economics, and in chapters in refereed books by publishers such as Oxford University Press. He has consulted for, among others, the World Bank, the UN, UNDP, the ADB, International Fund for Agricultural Development (IFAD), and Department for International Development (DFID), UK. His research has been funded by major organizations such as the MacArthur Foundation (Chicago), DFID (UK), the Australian Research Council, the AusAID, and IDRC (Canada). His research and teaching interest are in public economics, macroeconomics, development economics and environmental economics.

K. Kanagasabapathy, since May 2009 heads as Director, the EPW Research Foundation, a sister unit of Economic & Political Weekly under the Sameeksha Trust. Educated from Annamalai University, Indian Statistical Institute and University of Surrey (UK), he has a career spanning over more than 40 years in teaching, training and research. Between 2006 and 2009, he served as Consultant and Secretary to the Committee on Fuller Capital Account Convertibility and to the Committee on Financial Sector Assessment. Between 2001 and 2005, he served as Senior Advisor to Executive Director, Indian Chair at the International Monetary Fund (IMF). He retired from the Reserve Bank of India in February 2006, as Adviser in-Charge of Monetary Policy Department, after serving the institution in different capacities for more than 30 years since 1977. His other positions included Director/Chief General Manager, Internal Debt Management Department and Member of Faculty at the Bankers Training College. He was very closely associated with the reforms in money and government securities markets during the 1990s. Starting his career as Assistant Professor of Economics in the Tamil Nadu Education Service in 1968, he also served in the State Government’s Finance Department for about nine years till 1977. His professional interests are money, banking and financial markets.

Madhu Kannan is the MD & CEO, Bombay Stock Exchange Ltd. since May 2009. Previously, he was the Managing Director in the Corporate Strategy Group of Bank of America-Merrill Lynch. He joined Merrill Lynch in March 2008 as a Managing Director (Strategy and Business Development). In this role he focused on the development and execution of key strategic initiatives for Merrill Lynch in the emerging markets of Asia and Middle-East & North Africa (MENA) and the Global Sovereign Wealth Funds Group. Prior to the Bank of America-Merrill Lynch, Kannan was Senior Vice President at NYSE Euronext. During his stint at NYSE Euronext, he served in various senior roles across a range of businesses including Vice President, Corporate Client Group, Head of International Listings (Asia Pacific Region), and Managing Director, International Strategy and Business Development of the Exchange. He earned his undergraduate degree B.E. (Hons.) in Electrical and Electronics, M.Sc (Hons.), in Economics from BITS, Pilani, India and MBA in Finance from Vanderbilt University, USA. He was nominated as a Young Global Leader in 2007 by the World Economic Forum (WEF), based in Geneva, Switzerland.

K.G. Karmakar, Managing Director, National Bank for Agriculture and Rural Development (NABARD), born in April 1952, holds a PhD in Management (1996) from the Jamnalal Bajaj Institute of Management Studies, Mumbai and a postgraduate degree in Financial Management (1982). Karmakar has penned over 100 articles on rural credit, financial inclusion, microfinance and development banking. He has also authored six pioneering books including: (i) Agricultural Project Management for Banks, (ii) Rural Credit, Micro Finance and SHGs, and (iii) The Silenced Drums on Tribal Development. For over 35 years, he has served with various banking and financial institutions including the State Bank of India (1975-76), Reserve Bank of India (1976-1983) and NABARD since 1983, and is an authority in agricultural credit, microfinance project management, rural infrastructure development, rural banking and supervision development and planning. His seventh book Towards Financial Inclusion in India is being published in February 2011. He has also prepared three major reports for GoI/RBI relating to High Powered Committee for Financial Restructuring of Handloom Weaving Industry, Working Group on Outreach of Institutional Finance and Cooperative Reforms under Eleventh Five-Year Plan (2007-2012), December 2006 and Task Force on Empowering Board of Directors of RRBs, January 2007, and is a Member of the Committee ‘To formulate concrete bankable schemes for rural housing’. He is on the boards of 28 reputed institutions like IIM-Ahmedabad, NIRD-Hyderabad, KVIC-Mumbai , CAPART-New Delhi, etc.

Joseph Massey is the MD & CEO of MCX Stock Exchange (MCX-SX). He is instrumental in formulating and implementing policies, procedures and best practices at MCX-SX, besides overseeing strategic operations and overall functioning of the exchange. Prior to MCX-SX, he was heading the operations of Multi-Commodity Exchange of India. Massey has over 20 years of diverse corporate experience and had stints at leading financial organisations such as Life Insurance Corporation of India, the Reserve Bank of India, Stock Holding Corporation of India, and the Vadodara Stock Exchange. Before joining MCX, he was the head of Interconnected Stock Exchange of India—a collaboration of 15 regional stock exchanges. Massey has widely travelled and gains his rich experience from his visits to the world’s top exchanges such as NYMEX, LME, CBOT, CME, NYBOT, CCX, EURONEXT-LIFFE, IPE, NYSE, NASDAQ, PHLX, SEC, CFTC, LSE, SGX and DTC. He has also been a part of various committees of FMC, SEBI and the Government of India on various policy issues pertaining to commodities and securities market. He is also currently the chairman of South Asian Federation of Exchanges (SAFE), a regional forum of exchanges and regulated entities.

Swayam Prava Mishra is a PhD scholar in Economics at University of Hyderabad. Her research area is corporate credit risk assessment. She did her postgraduation in Economics also from University of Hyderabad. She specialises in econometrics, time series econometrics and financial economics. Mishra has presented a paper in an international conference in the area of corporate credit risk assessment. She has select publications on credit scoring models/performance of Indian banks in international and professional journals.

Ravi Narain is currently the MD and CEO of the National Stock Exchange of India Limited. He is the Chairman of the National Securities Clearing Corporation Ltd. and NSE.IT Ltd. He also serves as a Director of the National Securities Depository Ltd. and the National Commodity & Derivatives Exchange Ltd. and several other companies. He is also associated with various committees of the Securities & Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). Narain has degrees in Economics from St. Stephen’s College, Delhi University and Cambridge University, UK and a degree in business administration from Wharton School, University of Pennsylvania, USA.

Kirit S. Parikh, Former Member, Planning Commission, Government of India, is Chairman, Integrated Research and Action for Development (IRADe), New Delhi. He is also former (Founder) Director (Vice Chancellor), Indira Gandhi Institute of Development Research (IGIDR), Mumbai. He was honoured with Padma Bushan by the President of India in March 2009. He is a Fellow of the National Academy of Sciences, India. He has a D.Sc. in Civil Engineering and a master’s degree in Economics from MIT, US. He has been a professor of Economics since 1967. He was the Chairman of the Integrated Energy Policy Committee, Planning Commission. He was a Member of the Economic Advisory Council (EAC) of the Prime Ministers of India, Atal Behari Vajpayee, P.V. Narasimha Rao, Chandra Shekhar, V.P. Singh and Rajiv Gandhi. In 1978 he was given the Vikram Sarabhai Award for Systems Analysis and Management. In 1999, he was given the Visveswaraya Award by the Engineers’ Foundation in Kolhapur. He is also a recipient of Nayudamma Award for contribution to the welfare of mankind through developments in the fields of Economics and Energy in February 2005. He was honoured as the most distinguished and illustrious alumni of the decade from India by the Massachusetts Institute of Technology (MIT), US in September 2007. He was conferred the Distinguished Alumnus Award by Indian Institute of Technology (IIT), Kharagpur in September 2007. He has authored, co-authored and edited 29 books in the areas of planning, engineering, water resource management, trade policies and so on.

Ravi Parthasarathy, Chairman, Infrastructure Leasing & Financial Services Limited (IL&FS), has had an illustrious career. He started off as a management trainee with Citibank Bombay in 1974 and rose to be its Manager. The stint gave him exposure to merchant banking and corporate banking functions. From Citibank, he moved on to 20th Century Finance Corporation Limited, as Executive Director. By 1987, when he left the organisation, it had grown to be the largest private sector company in the financial services sector in the country. In 1988, Parthasarathy joined the IL&FS, a company, which promotes developing and financing diverse projects in surface transport, power, telecommunications, ports, SEZs, water supply and area development and works closely with Central government agencies, different state governments and local authorities in PPP format, and is responsible for all the operations of the group. Since the IL&FS also specialises in structured finance, broking and private equity, he has his hands full. A science graduate and MBA, Parthasarathy has also been on board of several reputed institutions including Indian Institute of Management (IIM), Bangalore.

Balamurali Radhakrishnan is a freelancer based in Hyderabad undertaking economic and financial research. Prior to this, Radhakrishnan served as a non-paid guest contributor for Europe Arab Bank (EAB), London. As a guest contributor, he worked on various key global economic and financial issues in association with the bank’s Head of Treasury, Prof. Moorad Choudhry. Radhakrishnan has co-authored with the professor four articles that were published by EAB’s treasury department, and their article on global imbalances was published by the Business Standard, India. Prior to commencing his assignment for EAB, Radhakrishnan worked as a Junior Analyst at Dun & Bradstreet India Pvt. Ltd., Mumbai. As a Junior Analyst, he tracked Indian cement and chemical industry, and published quarterly reports on these industries. Prior to joining Dun & Bradstreet, Radhakrishnan worked as a Research Associate for Brigade Corporation, Hyderabad.

Yaga Venugopal Reddy was Governor, Reserve Bank of India, from 2003 to 2008. Subsequently, he was Member of the UN Commission of Experts to the President of the UN General Assembly on Reforms of International Monetary and Financial System. He is currently Professor Emeritus, University of Hyderabad. He is also Honorary Fellow of the London School of Economics and Political Science. He is a Member of an informal international group of prominent persons on International Monetary Reforms, and is also on the Advisory Group of eminent persons to advise the Finance Minister of India on G20 issues. Prior to being the Governor, he was Executive Director for India, Sri Lanka, Bangladesh and Bhutan at the International Monetary Fund since August 2002. Prior to this, he was Deputy Governor, Reserve Bank of India, for six years. Formerly, he was Secretary, Ministry of Finance, and Additional Secretary, Ministry of Commerce in the Government of India. He served Government of Andhra Pradesh, India in several capacities including Principal Secretary and Secretary (Finance and Planning), Collector and District Magistrate etc. He was also advisor in World Bank. Dr. Reddy was honoured with the Padma Vibhushan Award in 2010. His book India and the Global Financial Crisis : Managing Money and Finance was among the best sellers in India (2009). His most recent publication is titled Global Crisis, Recession and Uneven Recovery (2011).

Duvvuri Subbarao assumed office as the Governor of the Reserve Bank of India (RBI) on 5 September 2008. Prior to this appointment, Dr. Subbarao served as Finance Secretary to the Government of India from April 2007 to September 2008 and as Secretary to the Prime Minister’s Economic Advisory Council (PMEAC) from March 2005 to March 2007. As a member of the Indian Administrative Service (IAS), Subbarao has been a career civil servant. Over the years of 1988-1998, he worked in various positions in State government of Andhra Pradesh and Government of India. Subbarao was a Lead Economist in the World Bank (1999-2004), where he also task managed a flagship study on decentralisation across major East Asian countries which was acknowledged as innovative policy work. He received BSc. (Hons) in Physics from the IIT, Kharagpur and MSc. in Physics from the IIT, Kanpur. Subsequent to joining the civil service, he received an MS in Economics from Ohio State University (1978) and was a Humphrey Fellow studying public finance at MIT during 1982-83. He earned his PhD in Economics from Andhra University (1998). Subbarao maintains a strong commitment to academic pursuits, and has written and lectured extensively on issues in public finance, decentralisation and political economy of reforms.

S.S. Tarapore, Distinguished Fellow, Skoch Development Foundation, has a BA (Economics) from Sheffield University (1958) and MSc. (Economics) from London University (1960). He was awarded the degree of Doctor of Laws (honoris causa) from Sheffield University (1996). He joined the Reserve Bank of India in 1961 as Research Officer and retired in 1996 as Deputy Governor. He was on deputation from 1971-1979, first in the IMF Research Department and subsequently under the IMF Central Banking Service with the Bank of Mauritius as Advisor to the Governor. He has chaired a number of official committees including the Committee on Capital Account Convertibility (1997), the Unit Trust of India Inquiry (2001), the Committee on Procedures and Performance Audit of Public Services (2004-05) and the Committee on Fuller Capital Account Convertibility (2006). He was a member of the Committee on Banking Sector Reforms (1998) and the Advisory Group on Transparency of Monetary Policy (2000).

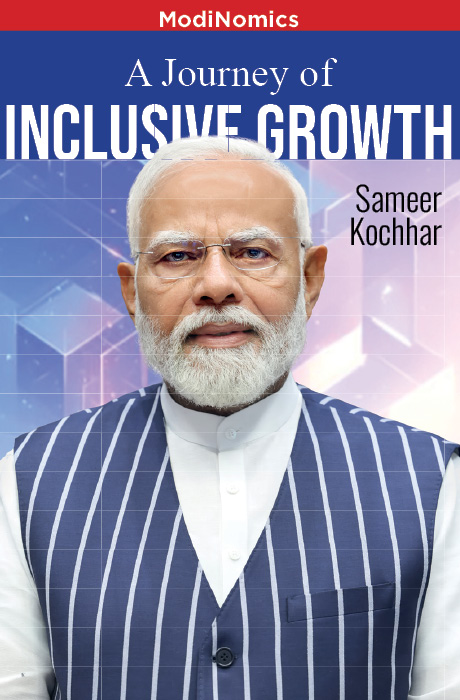

Reforms historian and author of the best-seller ModiNomics, Sameer Kochhar is Chairman, SKOCH Group. He is a passionate advocate of social, digital, and financial inclusion and is a foremost expert on governance and inclusive growth.

His work has been acclaimed globally and endorsed by Narendra Modi, M. Venkaiah Naidu, Manmohan Singh, Arun Jaitley, P. Chidambaram, Yashwant Sinha, C. Rangarajan and Montek Singh Ahluwalia.

In his thinking, writings, and activities, his profound admiration for India’s economic reforms and, by extension, those outstanding personalities who strive to make these reforms more meaningful and broad-based comes out clearly and unambiguously.

He has published over 17 volumes, the most notable being India 2030: A Socio-Economic Paradigm; ModiNomics; Defeating Poverty: Jan Dhan and Beyond; and Modi’s Odyssey: Digital India, Developed India.